Keeping track of your 1099 forms and filing your taxes can be overwhelming. The paperwork and various self-employed tax deductions are time-consuming to work through. We’ll walk you through the top self-employed tax deductions every business owner should consider claiming and guide you through the process to help you file your taxes accurately.

Here are the 17 self-employed tax deductions we’ll dive into:

While tax rules can be complex, self-employed professionals can deduct many business-related expenses. You want to take advantage of all the legal tax deductions you can. This will help reduce your tax bill and ensure you maximize profits. Let's start with six of the most common tax deductions:

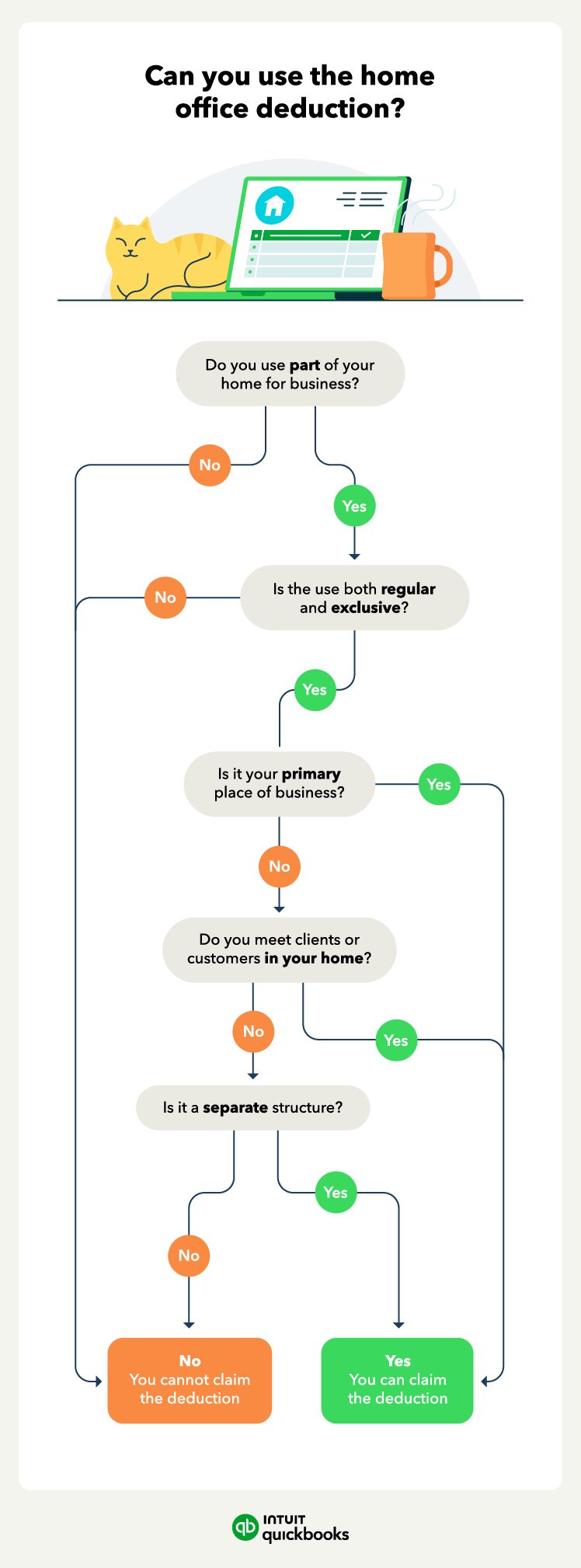

If you use part of your home for business purposes, you can take a deduction based on the square footage of your office. This deduction is available to those who use part of their home regularly and exclusively for business purposes.

To decide whether or not you can use the home office deduction , work through the following flowchart:

After determining whether you can take the home office deduction, it’s time to figure out which method to use. You can use either method, so it’s best to use the method that gives you the highest deduction.

There are two methods to choose from—regular and simplified. The regular method allows you to deduct part of your home expenses, such as rent, mortgage interest, repairs, and utilities.

To calculate the home office deduction using the regular method:

For example, say your home office is 150 square feet, your home is 2,000 square feet, and your yearly home expenses are $15,000.

Your home office deduction using the regular method is:

One thing to note as well, if you do sell your home in the future, your gain may also be subject to depreciation recapture. The simplified method is a bit simpler.

For the simplified method, you measure the square footage of your office area and multiply it by $5. From our above example, your home office deduction for a 150-square-foot office would be:

In our example, the regular method has a higher deduction amount, but it does take more work. Also, note that the simplified method has a $1,500 deduction limit. Even if your home office is more than 300 square feet, you can only deduct $1,500.

You can deduct a percent of your total home expense OR $5 per square foot (up to $1,500).

If you’re self-employed, you’re responsible for paying self-employment taxes , also known as the Federal Insurance Contributions Act (FICA). The FICA tax amount pays for Social Security and Medicare contributions.

The current self-employment tax rate is 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare. So, if you make $10,000, you’ll need to pay $1,530 in self-employment taxes.

However, 50% of what you pay in self-employment taxes is deductible. For example, if you pay $1,530 in self-employment taxes, you will be able to reduce your taxable income by $765.

You can deduct 50% of your self-employment taxes.

Do you regularly drive to meet clients or suppliers? If so, you can take advantage of the tax deductions for self-employed individuals to account for vehicle mileage or normal vehicle wear and tear. You can choose between two types of vehicle-related deductions: the standard mileage option or the actual expense option.

The standard mileage rate calculation for your vehicle-use deduction is:

Standard mileage rate deduction = business miles x IRS standard mileage rate

The current IRS standard mileage rate is $0.67 per mile. For example, say you use your personal car to drive 6,000 business miles, then your standard mileage rate deduction is:

Or you can track all your car expenses and multiply that by the amount of business-related miles you drove. The formula for the actual use deduction is:

Actual use deduction = total vehicle expenses x (business miles / total miles)

For example, your total car expenses were $7,000 for the year. You drove 6,000 miles for business and 4,000 for personal use for a total mileage of 10,000. The actual-use deduction in this example is:

Both the standard mileage and actual use methods both require you to track the miles you drive for business.

You can deduct a percentage of your total vehicle expenses OR the standard mileage rate.

If you contribute to a retirement plan for yourself, you may be able to deduct these contributions. This includes the individual retirement account (IRA), Simplified Employee Pension (SEP) plan, and 401(k) contributions.

Note that the annual retirement contribution limit will vary based on the retirement account—be sure not to overcontribute, or you could face a tax penalty.

You can deduct 100% of your retirement contributions, e.g. 401(k) or IRA contributions.

Many full-time employees receive health insurance through their employers. However, many professionals need to find their own self-employed health insurance . Those monthly premiums can add up to a hefty chunk of change every month.

Self-employed individuals who meet certain criteria may be able to deduct the cost of health insurance premiums. You can deduct premiums (for yourself and your family) if your business is generating a profit and you’re not eligible to enroll in an employer’s health plan.

You can deduct 100% of your health insurance premium payments.

Other tax write-offs available to self-employed individuals are travel expense tax deductions . If you travel to visit clients or attend conferences, you may be able to deduct the cost of travel. Business travel expenses include transportation and accommodation costs.

For example, if you are a freelancer who travels to attend networking events, you can deduct the cost of these trips. And if you are a consultant who visits clients, you can also deduct travel costs.

To be eligible for this deduction, you must be able to prove that the travel was ordinary and necessary for your business. When deducting your business travel expenses, you shouldn’t attempt to deduct any expenses associated with sightseeing and leisure travel.

You can deduct 100% of your travel expenses, e.g. plane tickets, hotels.

Let QuickBooks streamline your books and your business, so you can focus on what you do best.

Start hereThose are six of the most common deductions that almost all business owners can use. Now, let's take a look at some other common deductions for self-employed individuals.

If you are just starting your business, you can deduct your startup costs from your taxes. This includes things like legal and professional fees for registering as a self-employed business owner .

It is important to note that you can only deduct up to $5,000 of your startup costs from your self-employment taxes. You will need to write off any costs over the $5,000 deduction over 15 years.

You can deduct 100% (up to $5,000) of your startup costs, e.g., incorporation fees and website building costs.

Self-employed people typically engage in marketing to grow their business. If you spend money on advertising for your business, you can deduct these expenses from your taxes.

The IRS allows small business owners to deduct the cost of items like flyers, web advertisements, business cards, and print ads, along with other marketing expenses.

You can deduct 100% of your ad and marketing expenses, e.g., social media ads.

Another tax deduction available to self-employed individuals is the meal deduction. This deduction allows you to deduct the cost of meals necessary for your business. You can write off things like meals while entertaining clients.

However, the catch is that you can only deduct 50% of business meals with clients, meals for employees, and office snacks. For meals at companywide parties or food provided for free to the public, you can deduct 100%.

You can deduct 50% of your business-related meals and 100% for companywide parties.

With many shoppers turning to the internet to research services and products, creating a website can be key to success. Self-employed individuals can deduct costs for their business websites, such as domain and hosting fees.

Other software and subscription expenses you might be able to deduct include accounting software and cloud storage subscriptions. Self-employed individuals can deduct the full cost of any software or subscription if it's entirely for business use.

You can deduct 100% of your software and subscription expenses, e.g., accounting software and cloud storage.

If you spend money on office supplies for your business, you can deduct these expenses. Typical office supplies may include postage and stationery, but almost any repeat-purchase items you regularly use for your business can be office supplies. For example, highlighters, staplers, paper clips, dry-erase markers, and tape.

You can deduct 100% of your office supplies, e.g., pens and paper, printing supplies.

Small business owners who work at home—whether you consider yourself self-employed or a freelancer —can deduct part of their internet and phone costs. If you only use your internet or phone for business purposes, you can deduct the entire bill. But if you use either for personal use, you can only deduct the business use part.

For example, you’ll want to track your time if you use your cellphone for personal and business use. If you use your personal cell phone for business 50% of the time, you can deduct half your cell phone bill.

You can deduct 100% of your business-related internet and phone use.

There are even more tax deductions self-employed individuals can take—although these next five might be less common given the nature of self-employed businesses. However, they’re still worth capitalizing on if available to you.

If you spend money on dues for professional organizations, you can use those expenses to lower your tax burden. Memberships must be for your business, however.

For example, an accountant may consider the National Society of Accountants or the American Accounting Association as necessary memberships. You should keep detailed records of both your education expenses and dues.

You can deduct 100% of your membership dues, e.g., nonprofit organization dues.

Any type of insurance you have for your business is tax-deductible. For example, some businesses have to carry liability insurance, and any permits you pay for it are deductible.

You can also deduct insurance premiums that are helpful to your business, such as business income coverage or cybersecurity insurance . Note that premiums for life insurance are typically not tax-deductible.

You can deduct 100% of your business insurance, e.g., liability and cyber insurance.

If you have a business credit card, you can likely deduct any interest you pay. This also goes for business loans. For example, if you took out a loan to buy equipment for your business, any interest paid would be tax-deductible.

But you can only take an interest deduction that’s up to 30% of your adjusted taxable income. For example, if your adjusted taxable income is $50,000, your interest expense deduction cannot exceed $15,000.

Note the loan or credit card charges must be for your business. Interest paid for charges or loans related to personal use is not deductible.

You can deduct 100% (up to 30% of adjusted taxable income) of your travel interest expenses, e.g., credit card and loan interest.

If you rent office space, you can deduct the rent and utilities you pay. Or, if you rent space for other things related to your business, such as a warehouse, storage facility, or manufacturing plant, you can deduct those as well.

Note that you cannot deduct prepaid rent. You can only take a tax deduction for the time the property is in use during the tax year.

For example, say you pay $12,000 for a year of rent on July 1. You can only take a rental deduction of $6,000—the six months you will use the property during that tax year.

You can deduct 100% of your rent and utilities, e.g., warehouse and storage rent.

As a small business owner, finding ways to stand out from your competition is key. To stay ahead of the pack, many self-employed individuals attend online business courses and educational seminars.

The cost of these expenses can help you and your business, so the IRS lets freelancers deduct professional development expenses in full. This includes things like books and webinars as well. But they cannot be for general education—they must be related to your business.

You can deduct 100% of your education expenses, e.g., webinars and workshops.

If you’re self-employed, you can write off many expenses. Here’s a recap of the 17 best tax write-offs for self-employed individuals:

Filing self-employed and sole proprietorship taxes can be stressful—and the self-employed tax deductions may be confusing. However, by taking advantage of all possible deductions and understanding the requirements, you can minimize your tax burden and grow your business.

Use self-employed accounting software like QuickBooks Self-Employed to track expenses throughout the year and automatically post them as deductions for you.

Self-employed individuals can write off most business-related expenses. The general rule for an expense to be tax-deductible is that it is ordinary and necessary for your business.

What is the 20% self-employment tax deduction?The 20% self-employment deduction, also known as a qualified business income (QBI) deduction, is a deduction that allows business owners to deduct 20% of their qualified business income. There are income limitations , however. Your taxable income must be less than $191,950 for 2023 if single and $383,900 for joint filers.

Can you deduct self-employment tax?Yes, self-employed individuals can deduct 50% of their self-employment tax from their taxable income. The deduction is allowed whether you take the standard deduction or itemized deductions.

Can you deduct meals if you’re a self-employed individual?If you're a self-employed individual or sole proprietor, you can deduct meals if they’re related to your business. If your client reimburses you for the meals, you cannot deduct them.

This information is intended to outline our general product direction but represents no obligation and should not be relied on in making a purchasing decision.

*Customer testimonial based on usage of QuickBooks Solopreneur Beta.

**Product Information

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank, member FDIC.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Checking Account opening is subject to identity verification and approval by Green Dot Bank.

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.

Users must apply for both QuickBooks Payments and QuickBooks Checking accounts when bundled.

Instant Deposit: Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria, including delayed eligibility for new users and availability for only some transactions and financial institutions. The service carries a 1.75% fee in addition to standard rates for ACH, swiped, invoiced, and keyed card transactions. This 1.75% fee does not apply to payments deposited into a QuickBooks Checking account. Deposits are sent to the financial institution or debit card that you have selected to receive instant deposits. Scheduled instant deposits are run automatically; QuickBooks checks for eligible funds up to 5 times per day. Non-scheduled instant deposits are sent within 30 minutes. Transactions between 2:15 PM PT and 3:15 PM PT are excluded and processed next day. Deposit times may vary due to third party delays.

No minimum balances or monthly fees: There are no minimum balance requirements to open or maintain this account or obtain the listed APY. Other fees and limits apply. See Deposit Account Agreement for details.

Mileage tracking: Mileage tracking is only available to the master administrator of the QuickBooks Online account. Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Syncing bank and cards: Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions, and fees.

QuickBooks Live Tax: Powered by TurboTax, is an integrated service available to one-person businesses / sole proprietors who file Schedule C (form 1040). Additional terms and eligibility applies; fees may apply. Some tax situations may not be supported. For guarantee information, see: https://turbotax.intuit.com/corp/guarantees/

Requires QuickBooks Online mobile (“QBM”) application. QuickBooks Mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

# Claims

Get paid 4x faster: Four times faster based on U.S. customers using QuickBooks Online invoice tracking and payment features, compared to customers not using these features, from Aug 2022 to Jul 2023.

Recommended for you

23 must-use tax breaks for small businesses

January 22, 2024

10 commonly overlooked tax breaks for the self-employed

February 17, 2016

Itemized deductions: What they are, types, and how to claim them

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.